What Can the Last 5 Years of Programmatic Advertising M&A Transactions Tell Us About the Future of AdTech?

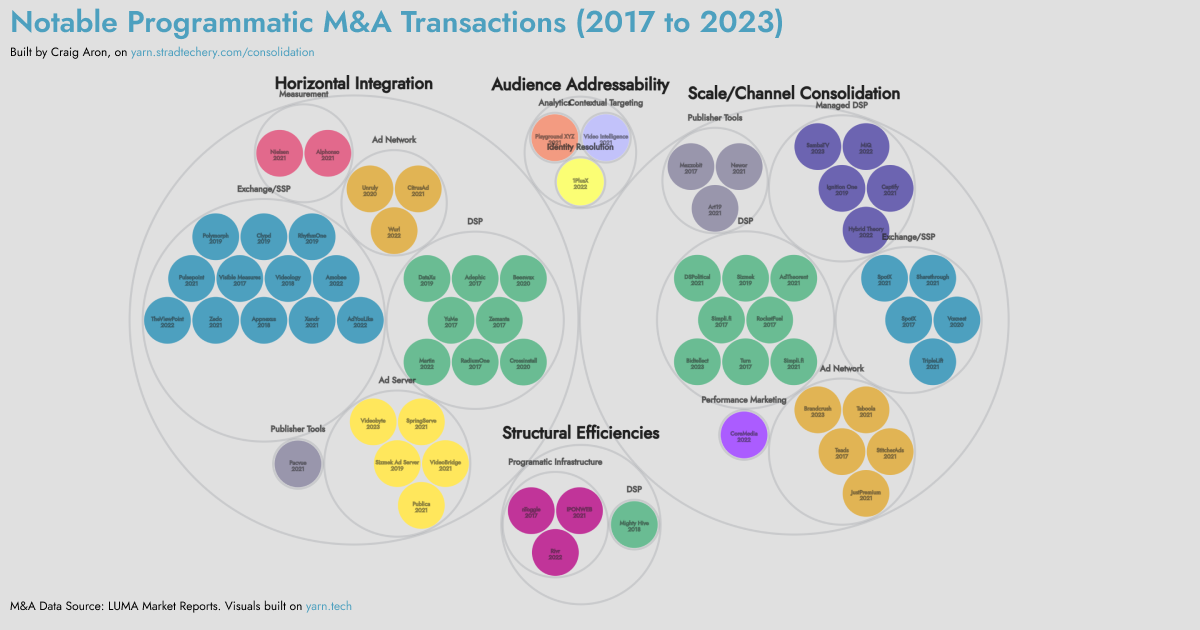

Looking back at notable M&A transactions that involved a DSP, SSP/exchange, ad network, or publisher monetization technology on at least one side of the transaction, two dominant themes have emerged.

Explore the Data Visualization

Two Dominant M&A Themes

58 of the 65 notable transactions can be categorized by two dominant themes:

Scale/Channel Consolidation : Reaching scale through significant private capital investment and/or the consolidation of emerging media channels, verticals, or formats.

Horizontal Integration : The convergence of buy and sell side businesses and/or a path to create efficiency via a two-sided market.

Scale/Channel Consolidation

The race to scale on the buy side of the programmatic ecosystem has been driven primarily by marketers' desire to have a unified view of the consumer and limited resources to effectively operate multiple buying platforms. This resulted in the vast majority of programmatic ad spend consolidating to a few large platforms or “mega DSPs”.

As ad spend accrued to the mega DSPs, they leveraged their market power to drive greater transparency on the sell side through implementing Supply Path Optimization (SPO) strategies to eliminate redundant supply and infrastructure cost. SSPs/exchanges maneuvered to remain relevant as SPO continues to march towards its end state.

While a handful of SSPs/exchanges have emerged as scaled players or “mega SSPs”, there continues to be greater fragmentation on the sell side as those efficiencies have conflicted with publishers' programmatic monetization strategies.

Horizontal Integration

As the mega DSPs and SSPs vied for scale, a parallel path combining sell side and buy side businesses emerged. With the objective to create more efficiencies and direct paths to supply for marketers, while aggregating unique demand for publishers (or to owned and operated properties from the newly combined entity).

This path provided an opportunity for subscale platforms to gain competitive advantages over the mega DSPs and SSPs through channel or vertical specialization (ex: CTV, Retail), or ownership of unique inventory or data assets.

As programmatic pipes and infrastructure continue to commoditize, demand aggregation becomes a primary function of the mega DSPs and SSPs. This has resulted in a blurring of the lines between them. As they push for continued growth while maximizing efficiencies, horizontal strategies are a viable way forward.

What Can the Past Tell Us About the Future of AdTech?

As the mega DSPs and SSPs compete for market share, the drive towards greater efficiencies will spark the final wave of the programmatic consolidation era.

Ad spend will continue to consolidate to a handful of mega DSPs, and subscale DSPs with unique assets (ex: channel, vertical, or format speciality) may find an exit as the mega DSPs winners are sorted.

The mega DSPs have the market power necessary to enforce a significant reduction of waste in the supply chain, and the industry movement towards sustainability further diminishes bidstream duplication as a viable monetization tactic for publishers.

Consolidation accelerates on the supply side as the mega SSPs continue to enhance their emerging channel capabilities or add vertical specializations.

Subscale SSPs with no clear publisher value proposition, channel or vertical speciality will likely not find an exit or soft landing.

The march towards Horizontal Integration will continue both organically and through M&A.